What, if any, unique characteristics of Y Combinator itself create substantial value in its portfolio companies? 37 YC Funded Companies Valued Over $40m was my previous blog post. That post was based on a tweet by Paul Graham that was subsequently reported by, among others, Business Insider and TechCrunch. The question I was left with after writing my post was: But did Y Combinator itself actually cause those companies to be worth that amount?

What, if any, unique characteristics of Y Combinator itself create substantial value in its portfolio companies? 37 YC Funded Companies Valued Over $40m was my previous blog post. That post was based on a tweet by Paul Graham that was subsequently reported by, among others, Business Insider and TechCrunch. The question I was left with after writing my post was: But did Y Combinator itself actually cause those companies to be worth that amount?

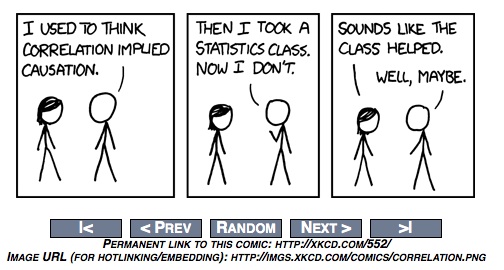

Correlation does not imply causation is a basic clarification that two events occurring together does not mean one event caused the other. In this case, the statement “37 YC cos have valuations of or sold for at least $40m” does not mean that Y Combinator caused those companies to be worth that amount. This sounds like I’m being a real downer, but please hear me out. In a comment, Mr. Graham states that most funding for YC companies immediately post Demo Day is now based on convertible notes. And that follows the rather controversial and abrupt termination of the Start Fund program just six months ago. If it’s so great, then why are the most informed Silicon Valley investors no longer thrilled about investing in companies funded by Y Combinator?

Some factors to consider: Y Combinator’s demographics consist mostly of college-educated individuals from top-tier schools like Stanford University and the Ivy League. Such people are likely to succeed no matter what they do, regardless of getting into Y Combinator. With two exceptions (YC W09 and YC W13), Y Combinator has consistently funded more companies each successive round. Funding more companies could only possibly result in a greater raw number of successes. As the hype around Y Combinator has increased over the years, the volume of applicants each round has also undoubtedly compounded. A greater applicant pool gives Y Combinator the ability to be more selective about participants.

Those factors all accrue to the benefit of the Y Combinator venture capital firm, not the portfolio companies. At most, those factors entitle Y Combinator to convince later-stage investors to invest in YC companies because Y Combinator is selective about who it lets into Y Combinator. And that still doesn’t explain any significant value created by Y Combinator itself.

I am completely certain that Y Combinator creates value in its portfolio companies. Y Combinator has its alumni network. Y Combinator’s partners have all personally been through at least one profitable exit. Yet I can’t isolate any specific attribute(s) of Y Combinator that explains the hype of Y Combinator, how Y Combinator itself creates significant value in its portfolio companies, and/or why big Silicon Valley investors seem increasingly less excited about Y Combinator funded start-ups. If I get closer to an answer to any of this, I’ll be sure and post it.